| CHECK THE APPROPRIATE BOX: | ||||||

| ☐ | Preliminary Proxy Statement | |||||

| ☐ | Confidential, | |||||

| ☑ | Definitive Proxy Statement | |||||

| ☐ | Definitive Additional Materials | |||||

| ☐ | Soliciting Material | |||||

| ☑ | Filed by the Registrant | ☐ | Filed by a | |||||||||

| CHECK THE APPROPRIATE BOX: | ||||||

| ☐ | Preliminary Proxy Statement | |||||

| ☐ | Confidential, | |||||

| ☑ | Definitive Proxy Statement | |||||

| ☐ | Definitive Additional Materials | |||||

| ☐ | Soliciting Material | |||||

| PAYMENT OF FILING FEE (CHECK | |||||||

| ☑ | No fee | ||||||

| ☐ | Fee paid previously with preliminary materials | ||||||

| ☐ | Fee computed on table | ||||||

Notice of

2021

Annual Meeting

of Shareholders and Proxy Statement

Monday, May 3, 2021 at 10 a.m. ET

Our Long-Term Growth Strategy

Annual Meeting of Shareholders

You are cordially invited to attend the Annual Meeting of Shareholders (“Annual Meeting”) of Aflac Incorporated (the “Company”), through its subsidiaries, provides financial protection to our millions of policyholders and customers worldwide. The Company’s principal business is supplemental health and life insurance products with the goal to provide customers the best value in supplemental insurance products in the United States (U.S.) and Japan. For nearly seven decades, insurance policies of the Company’s subsidiaries have given policyholders the opportunity to focus on recovery, not financial stress. In the U.S., Aflac is the number one provider of supplemental health insurance products. Aflac Life Insurance Japan is the leading provider of cancer and medical insurance policies in force in Japan.

| 2024 PROXY STATEMENT | |||||

You are cordially invited to attend the Annual Meeting of Shareholders (“Annual Meeting”) of Aflac Incorporated. This year’s Annual Meeting will be held virtually. You will be able to attend the Annual Meeting, vote, and |  |  | |||||||||||||||||||||||

| DATE AND TIME May 6, 2024 10:00 a.m. | ||||||||||||||||||||||||

| VIRTUAL (ONLINE ONLY) www.virtualshareholdermeeting.com/ | ||||||||||||||||||||||||

| |||||||||||||||||||||||||

You will be able to attend the Annual Meeting, vote, and submit your questions during the webcast. The Annual Meeting will be held for the following purposes, all of which are described in the accompanying Proxy Statement:

| ||||||||||||||||||||

| To elect as Directors of the Company the |  | |||||||||||||||||||

| ||||||||||||||||||||

| RECORD DATE February 27, 2024 | |||||||||||||||||||

|  | |||||||||||||||||||

| To consider a non-binding advisory proposal on the Company’s executive compensation (“say-on-pay”) |  |  | ||||||||||||||||||

How to Vote It is important that you vote your shares. We offer several easy and cost-effective voting methods for your convenience. | ||||||||||||||||||||

|  | |||||||||||||||||||

| To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, |  |  | ||||||||||||||||||

In addition, any other business properly presented may be acted upon at the meeting and at any adjournments or postponements of the meeting.

It is important that you vote your shares. We offer several easy and cost-effective voting methods for your convenience.

|  |  | See page 77 | |||||||||||||||||

In addition, any other business properly presented may be acted upon at the meeting and at any adjournments or postponements of the meeting. The accompanying proxy is solicited by the Company’s Board of Directors on behalf of the Company. The Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, are enclosed.(1) The record date for determining which shareholders are entitled to vote at the Annual Meeting is February 27, 2024. Only shareholders of record at the close of business on that date, or their duly appointed proxies, will be entitled to vote at the Annual Meeting and any adjournment thereof. For more information on how to attend the virtual Annual Meeting, please see Appendix B of the Proxy Statement. Your vote is important! Even if you expect to attend the virtual Annual Meeting, please vote in advance. If you attend the Annual Meeting online, you may revoke your proxy by submitting a vote during the Annual Meeting. We are making the Proxy Statement and the form of proxy first available on or about March 21, 2024. By order of the Board of Directors,  |  | INTERNET Visit | ||||||||||||||||||

| TELEPHONE If your shares are held in the name of a broker, bank, or other nominee, follow the telephone voting instructions, if any, provided on your proxy card. If your shares are registered in your name, call 1-800-690-6903 and follow the telephone voting instructions. You will need the 16-digit control number that appears on your proxy card. | |||||||||||||||||||

| MAIL If you received a full package by mail, complete and sign the proxy card and return it in the enclosed postage pre-paid envelope. | |||||||||||||||||||

The accompanying proxy is solicited by the Company’s Board of Directors on behalf of the Company. The Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, are enclosed.(2) The record date for determining which shareholders are entitled to vote at the Annual Meeting is February 23, 2021. Only shareholders of record at the close of business on that date will be entitled to vote at the Annual Meeting and any adjournment thereof.

Your vote is important! Even if you expect to attend the virtual Annual Meeting, please vote in advance. If you attend the Annual Meeting online, you may revoke your proxy by submitting a vote during the Annual Meeting.

By order of the Board of Directors,

J. Matthew Loudermilk

Secretary

March 18, 2021

Columbus, Georgia

J. Matthew Loudermilk Corporate Secretary March 21, 2024 Columbus, Georgia | (1)Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May |  | TABLET OR SMARTPHONE Scan the QR code that appears on your proxy card or notice using your mobile device. | |||||||||||||||||

| 2 | AFLAC INCORPORATED | ||||

As I reflect on 2023, I am very proud that our management, employees and sales distribution teams have continued to be resilient stewards of our business. Our goal is to provide customers with the best value in supplemental insurance products in the United States and Japan. As we embark on 2024, we will celebrate our 50th year of doing business in Japan and 50th year as a publicly traded company on the NYSE. We also are reminded that one thing has not changed since our founding in 1955: families and individuals still seek to protect themselves from financial hardship that not even the best health insurance covers. Today’s complex health care environment has produced incredible medical advancements – with incredible costs – and it’s more important than ever to have a partner. With our inventive approach to offering relevant products, we believe we are that partner. Growth For 2023, Aflac Incorporated reported $4.7 billion in net earnings, or $7.78 earnings per diluted share. As a result, net earnings per diluted share rose 12.3%. Adjusted earnings per diluted share* were $6.23, the best year in history despite a weakening yen and the impact of a reinsurance retrocession late in the fourth quarter. When adjusting for the $0.19 per diluted share impact of the yen, adjusted earnings per diluted share excluding the impact of foreign currency* were $6.43, which was a 13.4% increase year over year. | I am pleased with our sales growth in both Japan and the U.S. In early 2023, Aflac Japan completed the rollout of our new cancer product, and we rolled out our new medical product in mid-September that appeals to younger policyholders and provides an opportunity to older policyholders to update their coverage. In the U.S., we enhanced our cancer policy, delivering even greater value to our policyholders. At the same time, we continue to concentrate on scaling up our network dental and vision and our group life and disability businesses in the U.S. in an additional effort to grow our core supplemental health business. We have also improved persistency in the United States while maintaining strong persistency in Japan well above 90%. We will continue to pursue profitable growth in both the U.S. and Japan with an eye toward improving and maintaining strong persistency. Strategic Capital Deployment We place significant importance on continuing to achieve strong capital ratios in the U.S. and Japan on behalf of our policyholders and shareholders. In addition, we have taken proactive steps in recent years to defend cash flow and deployable capital against a weakening yen. We pursue value creation through a balance of actions including growth investments, stable dividend growth and disciplined, tactical stock repurchase. | 2023 marked the 41st consecutive year of dividend increases. We treasure our track record of dividend growth and remain committed to extending it, supported by the strength of our capital and cash flows. Last quarter, the Board put us on a path to continue this record when it increased the first quarter 2024 dividend 19% to $0.50. Additionally, we have remained tactical in our approach to repurchasing shares throughout 2023, which led to the historically high $700 million per quarter. As a result, we deployed $2.8 billion in capital to repurchase nearly 39 million of our shares in 2023. Combined with dividends, this means we delivered over $3.8 billion back to shareholders in 2023, while also investing in the growth of our business. At the same time, we have maintained our position among companies with the highest return on capital and lowest cost of capital in the industry. I like to think that it is efforts like the above that lead to recognition such as appearing on Fortune’s List of World’s Most Admired Companies for the 23rd time, ranking No. 1 in the Insurance: Life and Health industry as a long-term investment for the second consecutive year. Overall, I think we can say that 2023 was another strong year. We believe in the underlying strengths of our business and our potential for continued growth in Japan and the U.S. – two of the largest life insurance markets in the world. We are well-positioned as we work toward achieving long-term growth while also ensuring we deliver on our promise to policyholders. | |||||||

| * Adjusted earnings per diluted share and adjusted earnings per diluted share excluding foreign currency impact are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). See Appendix A to this Proxy Statement | |||||||||

| LETTER FROM THE CHAIRMAN, CHIEF EXECUTIVE OFFICER AND PRESIDENT | 2024 PROXY STATEMENT | 3 | ||||||

Letter from the Chairman and Chief Executive Officer

March 18, 2021

Dear Fellow Shareholder:

When I wrote this letter last year, it would have been very difficult to foresee the gravity of what was soon to unfold for our society and for our company due to COVID-19. 2020 was certainly a year that tested the world, including all of us at Aflac Incorporated. While pandemic conditions are ongoing, I am proud to say that 2020 confirmed what I knew all along: the Company is strong, adaptable and resilient.

I want to thank you, our shareholders, as well as our employees and our sales distribution for supporting the people-first initiatives we spearheaded in both the U.S. and Japan in response to the COVID-19 pandemic. In Japan and the U.S., these actions included introducing work-from-home staffing models for our employees to ensure business continuity; expanding COVID-19 coverage and enhancing claims payment protocols to help get funds in the hands of policyholders when they needed us most; expanding premium payment grace periods; interest-free loans; virtual technology initiatives for our sales force; and charitable contributions to help frontline workers.

Consistent with our culture and identity as a socially responsible company, and given our remote working conditions, we stepped up our engagement with our employees through virtual town hall meetings and weekly touch-base letters in which we affirmed our commitment to being there for our policyholders, supporting our employees and sales teams personally and professionally, and creating an ongoing dialogue about social justice among other topics. We advanced our Environmental, Social, and Governance (ESG) disclosures with a dedicated report outlining our ESG policies and adoption of a formal reporting framework for going forward. We were pleased to appear on Fortune’s List of World’s Most Admired Companies for the 20th time, ranking in the Life and Health Category at No. 5 for “Long-Term Investment Value” and No. 3 for both “Use of Corporate Assets” and “Global Competitiveness.”

Even amid the challenges of the current backdrop, we remain focused on helping to provide protection to our policyholders, growing our business, being a good corporate citizen, and driving shareholder value. In doing so, we’ve gained the trust of more than 50 million people worldwide. Following are some additional highlights that stand out from 2020:

GROWTH

While sales were impacted considerably in both Japan and the U.S. due to constrained face-to-face opportunities associated with social distancing protocol and the COVID-19 pandemic, we did anything but sit still. We maintained forward motion, accelerating investment in our platforms and technology while continuing strong earnings performance. In 2020, Aflac Incorporated generated $4.8 billion in net earnings, or $6.67 per diluted share, up 44.6% and 50.6% from last year, respectively, and an increase in adjusted earnings per diluted share on a currency-neutral basis of 10.8% to $4.92, driven by a reduction in the tax rate and higher share accretion. Our results are especially meaningful given pandemic conditions, the low-interest-rate environment in Japan, and absorbing our extensive investments in the business to drive future earned premium growth, which will remain a critical strategic focus for 2021.

STRATEGIC CAPITAL DEPLOYMENT

We place significant importance on continuing to achieve strong capital ratios in the U.S. and Japan on behalf of our policyholders and shareholders. When it comes to capital deployment, we pursue value creation through a balance of actions including growth investments, stable dividend growth, and disciplined, tactical stock repurchase. Accordingly, our Board of Directors increased the cash dividend 3.7% in 2020, marking the 38th consecutive year of dividend increases. We are very proud of and seek to extend this track record, which is supported by the strength of our capital and cash flows and evidenced by the announcement of a 17.9% increase in the quarterly cash dividend effective with the first quarter of 2021. Fortunately, we entered this pandemic in a very strong capital and liquidity position, which allowed us to confidently repurchase $1.5 billion, or 37.9 million of our shares, in 2020, consistent with our tactical

|

| “We are well-positioned as we work toward achieving long-term growth while also ensuring we deliver on our promise to policyholders. ” |

Doing the Right Thing: The Aflac Way Doing the right thing is engrained in The Aflac Way, which has been the cornerstone of how we do business in the U.S. and Japan. Operating this way, we are privileged to help provide financial protection to our policyholders during their time of need. We believe in cultivating and welcoming diversity in our operations, workforce, management team, and Board. We have found that this approach makes good business sense by enabling us to serve our customers better. Plus, we believe people want to do business with a company doing the right thing. As the pioneer of supplemental cancer insurance in both the U.S. and Japan, it has perhaps been most visible in our dedication to children facing cancer and other serious diseases. 2023 marked the 28th year of our partnership with the Aflac Cancer and Blood Disorders Center of Children’s Healthcare of Atlanta, which has become nationally renowned as one of the leading childhood cancer, hematology, and blood and marrow transplant programs in the United States. Contributions from our all-commission sales force, our employees, our executives and Board have exceeded the $173 million mark. 2023 also represented the 23rd year of our partnership with the Aflac Parents House in Japan. Over the years, more than 150,000 pediatric patients and their family members have | called one of the three Aflac Parents House locations a home-away-from home while receiving treatment for cancer or other serious diseases. We also just completed the fifth full year in the U.S. and the fourth full year in Japan of offering My Special Aflac Duck, our smart comforting companion that helps children feel less alone by using state-of-the-art interactive technology during their cancer treatment. As you will note, Dr. Barbara Rimer will be retiring and not standing for re-election at the 2024 annual meeting. I would like to take this opportunity to express my gratitude to Dr. Rimer for her many years of insightful contributions and dedicated service to the Company since 1995. Her service was invaluable, especially during the pandemic, and we are so grateful. With these topics as a backdrop, we are privileged to be stewards of the trust and resources you, our owners, place in Aflac Incorporated every day, and we thank you for your support. It is my pleasure to invite you to virtually attend the 2024 Annual Meeting of Shareholders on Monday, May 6, 2024, where you can learn more about Aflac Incorporated’s recent business performance and strategy for the future. I encourage you to review the proxy materials and Annual Report on Form 10-K as well as Aflac Incorporated’s most recent Business | and Sustainability Report. Then, please vote your shares, even if you plan to attend the virtual Annual Meeting. We want to be sure your shares and your viewpoints are represented. Sincerely,  Daniel P. Amos CHAIRMAN, CHIEF EXECUTIVE OFFICER AND PRESIDENT | ||||||

Letter from the Chairman

| 4 | AFLAC INCORPORATED | ||||

It is an honor to serve you as Lead Non-Management Director, alongside such an eminent team of Directors. These fellow Board members bring their skills, expertise and experience from such a broad range of fields, industries and companies. In 2023, we maintained our focus on overseeing the risk and strategy of the Company. In this letter, I want to highlight some of the key topics of oversight in 2023. Risk Oversight Our Board provided oversight of the pertinent risks both for the industry and to the Company, while carefully monitoring traditional risks associated with investments and our products and maintaining strong capital ratios. The Board has overseen significant advancements in information security and enhanced information security policy. The goal is to ensure that the Company’s information assets, data, and the data of our customers, are protected. Board Succession, Refreshment and Onboarding Our Board retains its balance of tenured members as well as a refreshment with newer members. Independent Board members average about six years of service that provide a balance of expertise for you, the shareholders. Our Board is diverse not only with women and/or people of color comprising approximately 60% of its membership, but also in terms of experience and expertise in a wide range of disciplines, including public health, cybersecurity, investment and finance, insurance operations, the Japanese market, regulatory and risk | management, and marketing and public relations. By combining a diversified membership with such broad expertise and multi-disciplinary skills, we have established an adaptable, insightful and cohesive board that is equipped to pivot quickly to navigate ever-evolving markets. I also want to thank Dr. Barbara Rimer for her many years of service on the Board. In anticipation of this event, the Board was fortunate to have maintained public health expertise on the Board with the addition of Dr. Miwako Hosoda in 2023. Dr. Hosoda brings nearly 30 years of experience in the field of public health in Japan, our largest market. Corporate Finance and Investments In 2023, our investment portfolio continued to benefit from our disciplined strategic asset allocation process. This approach serves as the core to managing long-term asset performance expectations to meet our objectives for capital, risk and liquidity. We also placed equity investments in specialized asset classes as well as Sustainability investments. The Aflac Global Investments team has built a high-quality portfolio that we believe will serve our stakeholders well no matter the economic environment. Strategic Corporate Development As we pursue new ways to meet the needs of consumers, businesses and shareholders, we will continue to invest in our network dental and vision and group life, disability, and absence management platforms. | These new business lines modestly impact the top line in 2023. We will continue to leverage these new platforms to enable our core products for future long-term growth. Commitment To Sustainability Aflac Incorporated has been carbon neutral in Scope 1 and Scope 2 emissions since 2020 and focused on being and achieving net zero emissions by 2050. We will continue to evaluate and evolve our approach to achieving our objectives. We have posted our Sustainability Policies and Statements at investors.aflac.com under “Sustainability” for several years, and we updated them in 2023 with Occupational Health and Safety in the Workplace and Responsible Investment Stewardship and Engagement policies. Such transparency and efforts to improve our sustainability have received external recognition, too. In 2023, Aflac Incorporated was included on the Dow Jones Sustainability North America Index for the 10th time and on Bloomberg’s Gender-Equality Index for the fourth consecutive year. Most recently, Ethisphere recognized Aflac Incorporated as one of the World’s Most Ethical Companies for the 18th consecutive year, remaining the only insurance company in the world to receive this honor every year since this award was first introduced in 2007. | ||||||

| LETTER FROM THE LEAD NON-MANAGEMENT DIRECTOR | 2024 PROXY STATEMENT | 5 | ||||||

| “As we shape the Aflac of the future, we do so knowing the Company’s success and financial performance are rooted in our commitment to our purpose.” | ||||

In addition, we have also worked to be a reflection of the communities that we serve by being an inclusive workplace and cherishing the value that diversity can bring. To reinforce our commitment to sustainability, officers have had a short-term incentive compensation modifier based on core sustainability targets since 2021. While the modifier led to no adjustment to officers’ short-term incentive compensation in 2023, we are still proud of our achievements related to responsible investing, diverse leadership and use of sustainable electricity. Shareholder Engagement We are proud to have been the first publicly traded company in the United States to voluntarily allow shareholders a say-on-pay vote. This is a prime example of how we are responsive as a Board and as a Company to our shareholders. We communicate with our shareholders on a regular basis to understand the issues and concerns that are important. We incorporate this feedback into our | decision-making process. We believe that open communications can have a positive influence on our performance, and we look forward to continuing open discussion with our shareholders going forward. As Lead Non-Management Director, I will continue to engage with our investors, seek insight into their perspectives, and explore the viewpoints and positions of those who invest in our business. The Board looks forward to continuing its ongoing dialogue with investors and applying that feedback to help inform business matters as they emerge. We thank you for your support and the privilege of representing you in Aflac Incorporated. | With these vital topics in mind, I encourage you to review the accompanying Proxy Statement and associated materials and vote before our virtual Annual Meeting on May 6, 2024. It is my pleasure, and my privilege, to serve on Aflac Incorporated’s Board, and I look forward, as a fellow shareholder, to witness how the Company works every day to uphold its promises. Sincerely,  W. Paul Bowers LEAD NON-MANAGEMENT DIRECTOR | ||||||

| 6 | AFLAC INCORPORATED | ||||

2023 BUSINESS HIGHLIGHTS | ||||||||

| ||||||||

| ||||||||

2023 Perquisites | ||||||||

| ||||||||

| 2024 PROXY STATEMENT | 7 | ||||

2023 BUSINESS HIGHLIGHTS In 2023, the Company delivered strong operating results. |  | ||||||||||||||||||||||

| NET EARNINGS | EARNINGS PER DILUTED SHARE (EPS) | RETURN ON EQUITY (ROE) | |||||||||||||||||||||

$4.7B 5.5%p | $7.78 12.3%p | 22.1% | |||||||||||||||||||||

| ADJUSTED EARNINGS EX-FX* | ADJUSTED EPS EX-FX* | ADJUSTED RETURN ON EQUITY (AROE) EX-FX* | |||||||||||||||||||||

$3.8B 6.4%p | $6.43 13.4%p | 14.2% | |||||||||||||||||||||

NEW ANNUALIZED PREMIUM SALES(1) - AFLAC JAPAN (IN YEN) | NEW ANNUALIZED PREMIUM SALES(1) - AFLAC U.S. | ||||||||||||||||||||||

10.9%p | 5.0%p | ||||||||||||||||||||||

| CASH DIVIDEND | REPURCHASED SHARES | 3-YEAR TOTAL SHAREHOLDER RETURN (“TSR”) | |||||||||||||||||||||

5.0%p | $2.8B | +99.6% | |||||||||||||||||||||

*Adjusted earnings and adjusted earnings per diluted share, excluding foreign currency impact, and AROE, excluding foreign currency impact, are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). See Appendix A to this Proxy Statement for definitions of these non-GAAP measures and reconciliations to the most comparable GAAP financial measures. (1)As discussed in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations in the Company’s 2023 Annual Report on Form 10-K. Prior-year amounts have been adjusted for the adoption of accounting guidance on January 1, 2023 related to accounting for long-duration insurance contracts. For more complete information regarding the Company’s 2023 performance, please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. | |||||||||||||||||||||||

| 8 | AFLAC INCORPORATED | 2023 BUSINESS HIGHLIGHTS | ||||||

approach. We believe our capital position, by any measure, remains robust given our risk profile, and we continue to have among the highest return on capital and lowest cost of capital in the industry. We place significant importance on continuing to achieve a strong risk-based capital (RBC) and solvency margin ratio (SMR) on behalf of our policyholders and shareholders alike in the U.S. and Japan. Through a combination of dividends and share repurchase, we returned about $2.3 billion to our shareholders in 2020.

CORPORATE CULTURE OF DOING THE RIGHT THING – THE AFLAC WAY

While this was a year filled with unparalleled challenges, our belief in fostering and welcoming all forms of diversity and viewpoints in our operations remains unchanged throughout our workforce, management team, and in the composition of our Board. Not only is this the right approach to take, but it enhances our ability to respond to all of our constituents and live up to the commitments we make to our customers, to our fellow employees and to all the people who rely on us.

Sustainability Highlights

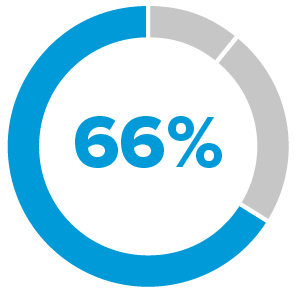

| Workforce Diversity •As of December 31, 2023, women accounted for 54% of Aflac Japan employees and 33% of Aflac Japan leadership roles. Women also held 27% of Aflac Japan management roles, as part of Aflac Life Insurance Japan Ltd’s longer-term plan to increase this percentage to 30% by 2025. •As of December 31, 2023, 49% of Aflac U.S. and the Company employees located in the U.S. were people of color and 66% were women. Women also occupied 51% of leadership roles located in the U.S. and 37% of senior management roles located in the U.S. In 2023, 57% of new hires located in the U.S. were people of color and 68% were women. | ||||

| Community Investment and Philanthropy •My Special Aflac Duck®is a “smart” robotic companion designed to help childrenwith cancer and sickle cell disease. We aim to put a My Special Aflac Duck in the hands of every child, age 3 and above, diagnosed with cancer and sickle cell disease in the U.S., Japan and Northern Ireland and has given My Special Aflac Ducks to more than 27,000 children through 2023. •We and our employees and agents are responsible for: •More than 150,000 pediatric patientsand their family members who have called Aflac Parents House a home-away-from-home while receiving treatment for serious illnesses, like cancer. •$173 million in support of Aflac Cancer and Blood Disorders Center of Children’s Healthcare of Atlanta, helping make it one of the top pediatric cancer programs in the United States by U.S. News and World Report. | ||||

| Environment •Reduced combined Scope 1 and 2 market-based greenhouse gas emissions by more than 90% from 2007 to 2022 •Expect 2023 to be the 4th consecutive year for being carbon neutral for Scope 1 and 2 emissions •Goal of net zero emissions by 2050 | ||||

Doing the right thing is embodied in The Aflac Way, which is woven into the actions of those who represent the Company everywhere. One of the seven commitments of the Aflac Way I referred to in my letter last year was “Treat Everyone with Respect and Care,” and I am proud to say that this commitment was honored time and time again in 2020. This commitment extends to our outreach into the communities in which we do business and operate. This takes shape in various ways within the Aflac family, but most prominently in our dedication to children facing cancer and their families. In addition to marking the 65th year since Aflac Incorporated’s founding and the Aflac Duck’s 20th birthday, 2020 marked the 25th anniversary of our partnership with the Aflac Cancer and Blood Disorders Center of Children’s Healthcare of Atlanta. It also marked the second year in the U.S. and the first full year in Japan of My Special Aflac Duck, our smart comforting companion that helps children feel less alone by using interactive technology during their cancer treatment.

In closing, I would like to express my gratitude to you, our shareholders, for putting your faith, confidence, trust, and resources in Aflac Incorporated. As we look ahead, delivering on our promise to be there for all of our constituents—you, our shareholders; our employees and sales force; and our policyholders and customers—will remain our priority because that is not only what sets us apart, it’s just who we are.

With these updates as a backdrop, it is my pleasure to invite you to virtually attend the 2021 Annual Meeting of Shareholders on Monday, May 3, 2021, where you can learn more about Aflac Incorporated’s recent business performance and strategy for the future. I encourage you to review the enclosed proxy materials and Annual Report on Form 10-K as well as Aflac Incorporated’s 2020 Business and Sustainability Report, which can be found at esg.aflac.com,“Sustainability” tab to learn more about our company and our latest accomplishments. Then, please vote your shares, even if you plan to attend the virtual Annual Meeting. We want to be sure your shares and your viewpoints are represented.

Sincerely,

Daniel P. Amos

CHAIRMAN AND CHIEF EXECUTIVE OFFICER

|  |  | ||||||

Principles for Responsible Investment (PRI) Signatory In 2021, Aflac Incorporated became a PRI Signatory, which works to understand the investment implications of ESG factors and to support its international network of investor signatories in incorporating these factors into investment and ownership decisions. | Dow Jones Sustainability North America Index (10th year), In 2023, the Company was included in the North American index and received high marks for Corporate Governance, Information Security/Cybersecurity & System Availability, and Tax Strategy. | Fortune’s World’s Most Admired Companies (23rd year), ranking No. 1 in the Insurance: Life and Health category as a long-term investment for the second consecutive year. | ||||||

|  |  | ||||||

Points of Light’s Civic 50 List (6th consecutive year), which showcases how leading companies are moving social impact, civic engagement and community to the core of their business. | Ethisphere’s World’s Most Ethical Companies (18th consecutive year), making it the only insurance company in the world to hold this distinction every year since the inception of the honor in 2007. | Bloomberg’s Gender-Equality Index (4th consecutive year), which tracks the financial performance of public companies committed to supporting gender equality through policy development, representation, and transparency. | ||||||

| 2024 PROXY STATEMENT | 9 | |||||||

Letter from the Lead Non-Management Director

March 18, 2021

To My Fellow Shareholders:

I am privileged to serve as Lead Non-Management Director, working with an esteemed team of Board members who demonstrate expertise and acumen in a broad range of disciplines. In the face of an unimaginable, challenging year, the resolve of this Board was stronger than ever as we leveraged our expertise to oversee Aflac Incorporated’s effective and comprehensive response to the global COVID-19 pandemic. Throughout it all, we worked together as one team, while maintaining corporate governance practices and focusing on our business continuity and strategy. I want to share some of the key areas on which my fellow directors and I have focused this past year.

GLOBAL COVID-19 PANDEMIC RESPONSE: ILLUSTRATES THE IMPORTANCE OF A WELL-ROUNDED BOARD

Just as we promote diversity within our Company operations, we cultivate diversity and well-rounded expertise within our Board to ensure we have a 360-degree view of our operations. Looking at 2020, the importance and benefit from this approach cannot be overstated. For example, the Aflac Incorporated Board drew upon the experience of all its members, and in particular Dr. Barbara Rimer, dean of the University of North Carolina Gillings School of Global Public Health, whose public health expertise was invaluable in helping guide us through the pandemic. Together, the team worked in lockstep to ensure proper oversight and that management was fully engaged in taking care of employees, policyholders, shareholders, and the community as we navigated the pandemic. Notable action-items include the broad expertise in the medical arena that prompted us to pivot early to remote staffing models; the expertise in IT and cybersecurity that helped accelerate virtual technology and protect sensitive information; and the risk oversight that helped ensure controls were in place. While the number of formally planned meetings remained unchanged, the scope of information and communications increased substantially as the Board moved swiftly to take action during this unprecedented time.

STRATEGIC CORPORATE DEVELOPMENT

Early in 2020, it became clear that despite the challenges we were facing, it was vital to advance the momentum of our investment in the long-term growth of our Company. This momentum included integrating and building upon our 2019 acquisition of Argus (now Aflac Dental & Vision) for our planned national launch in 2021 as well as the 2020 closing of our acquisition of Zurich North America’s group benefits business. These two acquisitions help secure a more prominent spot when enrolling policyholders, which better positions Aflac U.S. for future success. Also in 2020, weclosed on a distribution alliance and ownership stake with Trupanion in the quickly growing market of pet insurance.

COMMITMENT TO SUSTAINABILITY

We began establishing, defining, and living Aflac Incorporated’s corporate purpose many years ago, even before this became a topic of interest among our investors. It was first thought of as the way we operate and later as the Aflac Way — guiding principles that exemplifies the compassion, ethics and spirit of the Company. The Aflac Way is an integral part of our corporate social responsibility and sustainability in creating long-term value for shareholders. We have seen moreinterest in Environmental, Social, and Governance (ESG) topics from investors and other stakeholders over the last several years. Consistent with our culture as a socially responsible company, we have advanced our ESG disclosures with a dedicated report outlining our ESG policies and capturing ourefforts through key disclosure frameworks, namely the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). To be a steward of the planet, we are committing this year to expanding our carbon emissions goal to be net zero, including our Scope 3 emissions, by 2050. This global net-zero climate commitment will demand a comprehensive and transparent approach, and thus we will provide appropriate reporting and hold ourselves accountable along the way. We have enhanced our disclosure in other meaningful ways this past year by posting online our approach to ESG Investing, Tax, Carbon Neutrality, Human Rights, Human Capital Management, Diversity and Inclusion, Supply Chain Approach and Philosophy, Cybersecurity, and Aflac Global Investments ESG Investing. Visit Aflac Incorporated’s ESG site, esg.aflac.com, for these and additional disclosures that are aligned with our spirit of transparency and clarity on where we stand as a Company.

Letter from the Lead Non-Management Director

We are proud our efforts to increase our transparency and improve our sustainability have received external recognition. The Company was recognized by Ethisphere as one of the World’s Most Ethical Companies for the 15th consecutive year, remaining the only insurance company in the world to receive this honor every year since this award was first introduced in 2007. For the second time, Aflac Incorporated was recognized on Bloomberg’s Gender-Equality Index, which tracks the financial performance of public companies committed to supporting gender equality through policy development, representation, and transparency.

RISK OVERSIGHT

It is important that our Board maintains its focus on identifying risks that are relevant to both the industry and to the Company. Along with carefully monitoring traditional risks associated with investments and our product risk profile, as well as maintaining strong capital ratios and managing operational risk, the Board has overseen significant advancements in information security. The Board has enhanced our information security policy with the goal of ensuring that the Company’s information assets and data, and the data of its customers, are appropriately protected.

As lead director, I will continue engaging our investors, gaining insight into their perspectives, and considering the viewpoints and positions of those who invest in our business.

The Board looks forward to continuing its ongoing dialogue with investors and acting upon that feedback, and we thank you for your support and the privilege of representing you and your shares in Aflac Incorporated. With these vital topics in mind, I encourage you to review the accompanying Proxy Statement and associated materials and to vote your shares before our virtual Annual Meeting on May 3, 2021. It is my pleasure, and my privilege, to serve on Aflac Incorporated’s Board, and I look forward, as a fellow shareholder, to the many ways the Company will continue upholding its promises.

Sincerely,

W. Paul Bowers

LEAD NON-MANAGEMENT DIRECTOR

| |||||||||||

This summary highlights information contained elsewhere in this Proxy Statement, but it does not contain all of the information you should consider. For more information, please refer to the following:

AGENDA AND VOTING MATTERS

| nominees named in this |  | proxy statement. | ||||

| |||||||

|  | ||||||

| |||||||

|  | ||||||

| |||||||

Please read the entire Proxy Statement before voting. This Proxy Statement and the accompanying proxy are being delivered to shareholders on or about March 18, 2021.

For more complete information regarding the Company’s 2020 performance, please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. In this Proxy Statement, the terms “Company,” “we,” or “our” refer to Aflac Incorporated. The term “Aflac” refers to the Company’s subsidiary, American Family Life Assurance Company of Columbus. The term “Aflac U.S.” refers collectively to the Company’s United States insurance subsidiaries, Aflac; American Family Life Assurance Company of New York (Aflac New York), a wholly owned subsidiary of Aflac; Continental American Insurance Company (CAIC), branded as Aflac Group Insurance; and Tier One Insurance Company (TOIC); as well as Argus Dental & Vision, Inc. (Argus), a benefits management organization and national network dental and vision company. The term “Aflac Japan” refers to Aflac Life Insurance Japan Ltd. The term “Aflac Global Investments” refers to the Company’s asset management subsidiary, Aflac Asset Management LLC and its management subsidiary in Japan, Aflac Asset Management Japan Ltd.

Proxy Summary

| Election of Directors | |||||||||||||

Each Director stands for election annually. The following provides summary information about the | |||||||||||||

| See page 13 | ||||||||||||

| The Board of Directors recommends a vote FOR |  | |||||||||||

| Director | Committee Memberships | ||||||||||

| Name | IND | Age | Since | AR | C | CD | CG | CSR | E | FI | |

| DANIEL P. AMOS Chairman and Chief Executive Officer, Aflac Incorporated | 69 | 1983 | ● | ● | ||||||

| W. PAUL BOWERS Lead Director Chairman and Chief Executive Officer of Georgia Power Co. | ● | 64 | 2013 | ● | ● | ● | ● | |||

| TOSHIHIKO FUKUZAWA President and CEO, Chuo Real Estate Co., Ltd. | ● | 64 | 2016 | ● | ||||||

| THOMAS J. KENNY Former Partner and Co-Head of Global Fixed Income, Goldman Sachs Asset Management | ● | 57 | 2015 | ● | ● | ● | ||||

| GEORGETTE D. KISER Operating Executive, The Carlyle Group | ● | 53 | 2019 | ● | ● | |||||

| KAROLE F. LLOYD Certified Public Accountant and retired Ernst & Young LLP audit partner | ● | 62 | 2017 | ● | ● | ● | ||||

| NOBUCHIKA MORI Representative Director, Japan Financial and Economic Research Co. Ltd. | ● | 64 | 2020 | |||||||

| JOSEPH L. MOSKOWITZ Retired Executive Vice President, Primerica, Inc. | ● | 67 | 2015 | ● | ● | ● | ● | |||

| BARBARA K. RIMER, DrPH Dean and Alumni Distinguished Professor, Gillings School of Global Public Health, University of North Carolina, Chapel Hill | ● | 72 | 1995 | ● | ● | |||||

| KATHERINE T. ROHRER Vice Provost Emeritus, Princeton University | ● | 67 | 2017 | ● | ● | |||||

| MELVIN T. STITH Dean Emeritus of the Martin J. Whitman School of Management at Syracuse University | ● | 74 | 2012 | ● | ● | ● | ||||

| our executive compensation program. | ||||||||||||

Proxy Summary

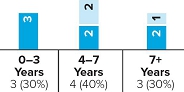

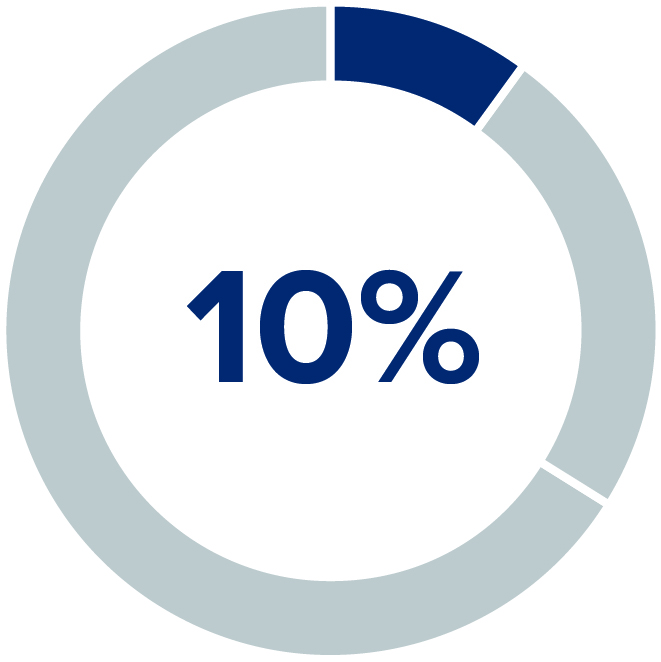

BOARD TENURE

2021 Independent Director nominees (10)

7 of 10 Independent Directornominees are minority and or women

DIVERSITY OF SKILLS, EXPERIENCE AND ATTRIBUTES

2021 all Director nominees (11)

Corporate Governance Highlights

| |

| |

| |

| |

| |

| |

| |

| |

|

|  |

percentage of the votes cast in favor of election of the nominees

Corporate Social Responsibility and Sustainability Highlights

We are proud of the accolades we have received, a handful of which are listed below, and we invite you to read Aflac Incorporated’s 2020 Business and Sustainability Report, at esg.aflac.com, to learn more about our initiatives.

Proxy Summary

| Executive Compensation (“Say-on-Pay”) | |||||||||||

We are committed to achieving a high level of total return for our | |||||||||||

| See page 38 | ||||||||||

| The Board of Directors and the Audit and Risk Committee recommend a vote FOR the selection of KPMG LLP. | ||||||||||

Ratification of Auditors In February 2024, the Audit and Risk Committee voted to appoint KPMG LLP, an independent registered public accounting firm, to perform the annual audit of the Company’s consolidated financial statements for fiscal year 2024, subject to ratification by its shareholders. | |||||||||||

|  | See page 77 | |||||||||

| 10 | AFLAC INCORPORATED | VOTING ROADMAP | ||||||

|  | Lead Non-Management Director |  |  | ||||||||||

DANIEL P. AMOS, 72 Chairman, Chief Executive Officer and President, Aflac Incorporated Director Since 1983 Committees: E, FI | W. PAUL BOWERS, 67 Retired Chairman and Chief Executive Officer, Georgia Power Co. Director Since 2013 Committees: AR*, CD, CSR, E | ARTHUR R. COLLINS, 64 Founder and Chairman of theGROUP Director Since 2022 Committees: CG, CSR | MIWAKO HOSODA, 54 Professor, Seisa University Director Since 2023 | |||||||||||

|  |  |  | |||||||||||

THOMAS J. KENNY, 60 Former Partner and Co-Head of Global Fixed Income, Goldman Sachs Asset Management Director Since 2015 Committees: CD, CSR, FI | GEORGETTE D. KISER, 56 Operating Executive, The Carlyle Group Director Since 2019 Committees: AR*, C | KAROLE F. LLOYD, 65 Certified Public Accountant and retired Ernst & Young LLP audit partner Director Since 2017 Committees: AR*, CD, E, FI | NOBUCHIKA MORI, 67 Representative Director, Japan Financial and Economic Research Co. Ltd. Director Since 2020 Committees: CG, FI | |||||||||||

|  | |||||||||||||

JOSEPH L. MOSKOWITZ, 70 Retired Executive Vice President, Primerica, Inc. Director Since 2015 Committees:AR*, C, CD, E | KATHERINE T. ROHRER, 70 Vice Provost Emeritus, Princeton University Director Since 2017 Committees: C, CG, E | |||||||||||||

| Committee Key | |||||||||||||||||||||||

| AR | Audit & Risk | C | Compensation | CD | Corporate Development | CG | Corporate Governance | ||||||||||||||||

| CSR | Corporate Social Responsibility & Sustainability | E | Executive | FI | Finance & Investment | l | Chair | ||||||||||||||||

| Independent | * | Financial Expert | ||||||||||||||||||||

| VOTING ROADMAP | 2024 PROXY STATEMENT | 11 | ||||||

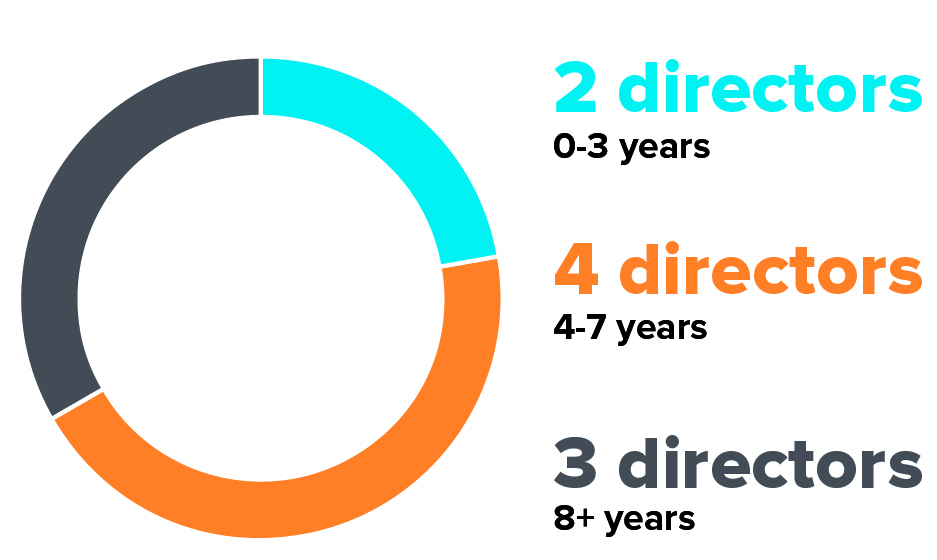

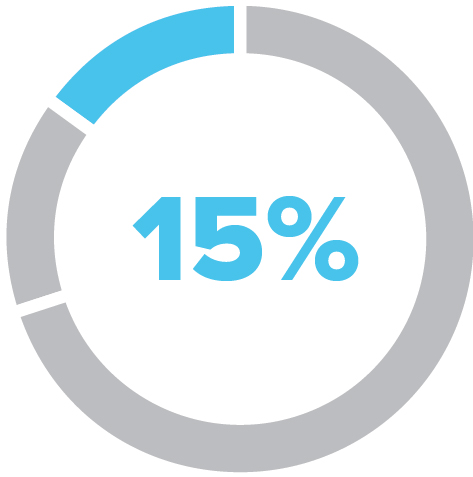

| 2 | 0-3 Years | 6 of 9 Independent Director Nominees are people of color and/or women | ||||||||

| 4 | 4-7 Years | ||||||||||

| 3 | 8+ Years | ||||||||||

Annual director elections Annual director elections Majority vote standard for director elections Majority vote standard for director elections  Independent Lead Non-Management Director Independent Lead Non-Management Director Active and responsive shareholder engagement process Active and responsive shareholder engagement process Annual Board evaluations, including individual director interviews Annual Board evaluations, including individual director interviews |  Shareholder ability to call special meetings Shareholder ability to call special meetings Shareholder right of proxy access Shareholder right of proxy access  Robust CEO succession planning process Robust CEO succession planning process Director mandatory retirement age Director mandatory retirement age | ||||

| 12 | AFLAC INCORPORATED | VOTING ROADMAP | ||||||

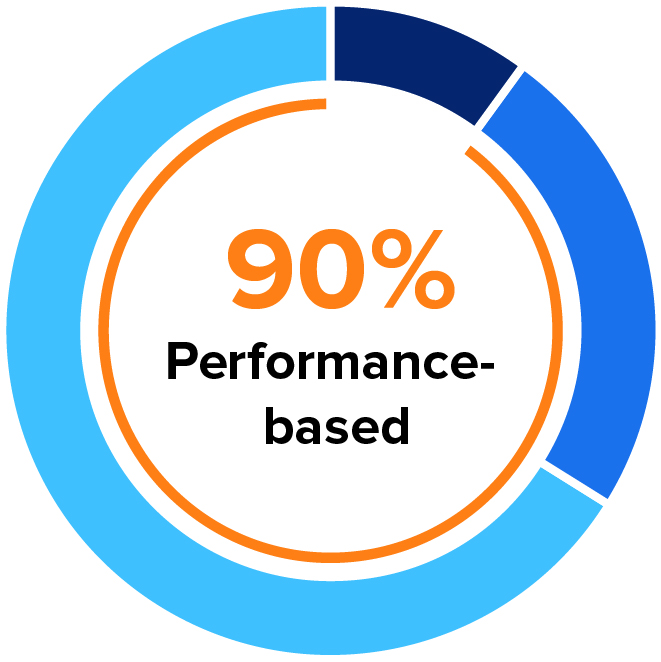

| Independent Oversight | •The Board’s independent Compensation Committee oversees the program. | ||||

| •The Compensation Committee retains an independent compensation consultant that reports only to that Committee. | ||||

| •The independent compensation consultant briefs the full Board annually on CEO pay and performance alignment. | ||||

| •All employees are prohibited from hedging Company stock. •Officers and Directors may not pledge the Company’s stock or, unless approved by the Compensation Committee, enter into 10b5-1 plans. •We do not provide change-in-control excise tax gross-ups. •All employment agreements contain double trigger change-in-control requirements. | ||||

| Long-Standing Commitment | •We have had a clawback policy since 2007. •We were the first public company in the U.S. to voluntarily provide shareholders with a say-on-pay vote – three years before such votes became mandatory. | ||||

| |||||

| |||||

| •Executive officers and Directors have been subject to stock ownership guidelines for almost two decades. | ||||

| |||||

| |||||

| |||||

The effect of COVID-19 created un-planned volatility in our results for the Aflac U.S. and Aflac Japan segments.

In 2020, the Company delivered strong operating results.

NET EARNINGS

$4.8B (44.6%)▲

EPS ADJUSTED EPS*

50.6%▲ 10.8%▲

RETURN ON EQUITY

15.3%▲

ADJUSTED RETURN ON EQUITY (“AROE”)*

15.0%▲

REPURCHASED SHARES

$1.5B

CASH DIVIDEND

3.7%▲

3 YEAR TSR

+8.6%

Proxy Summary

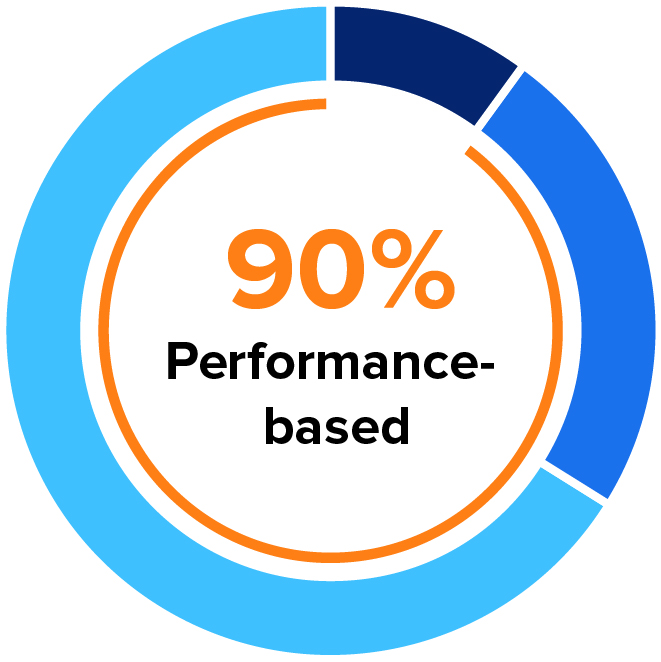

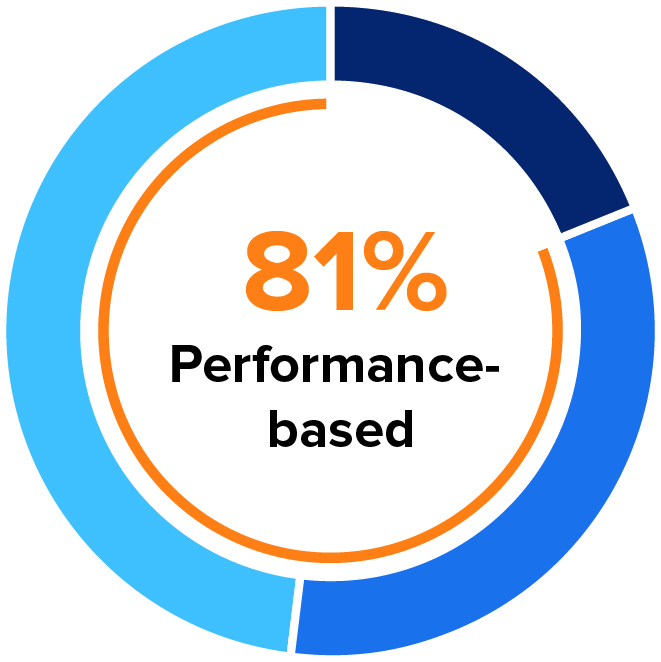

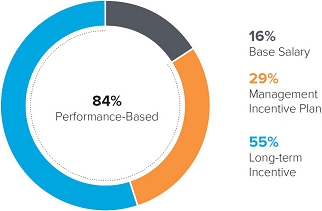

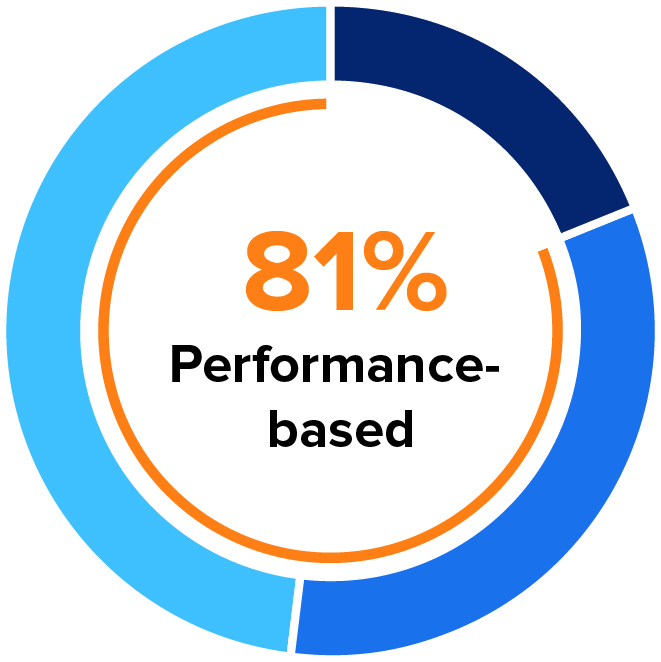

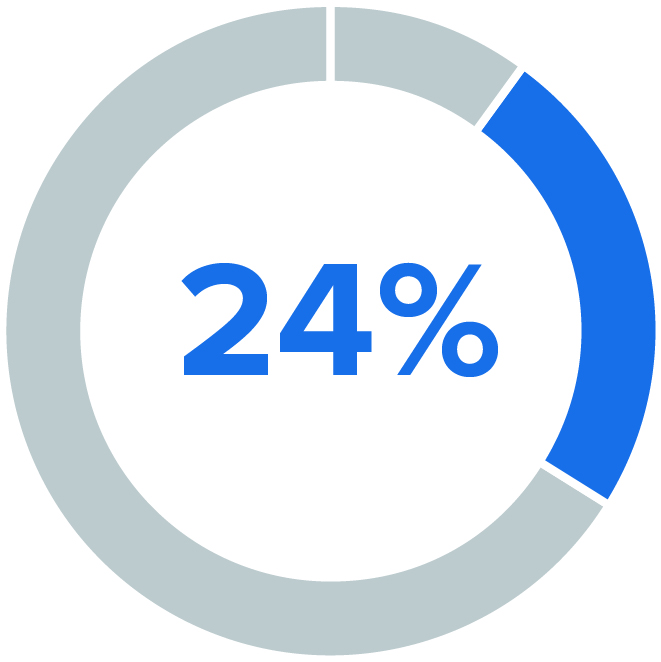

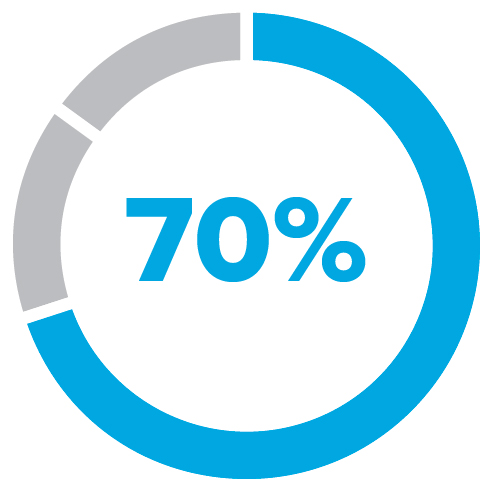

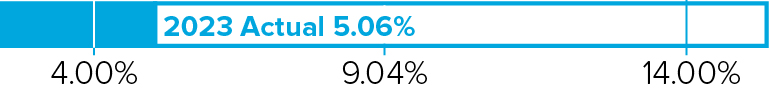

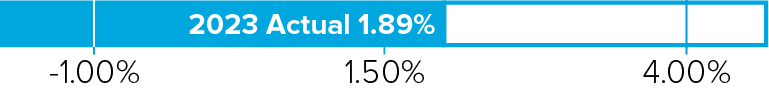

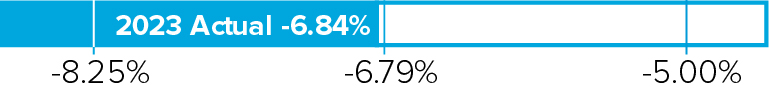

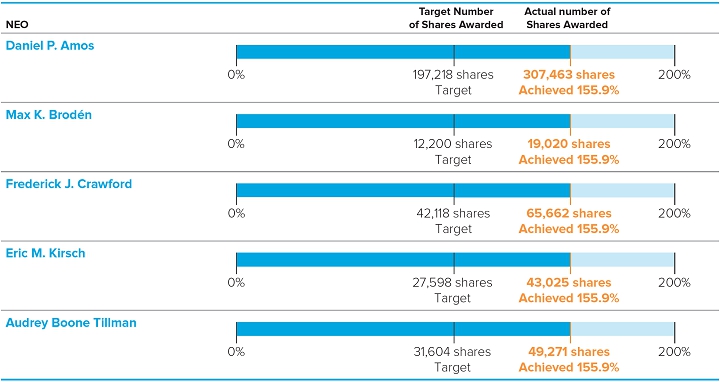

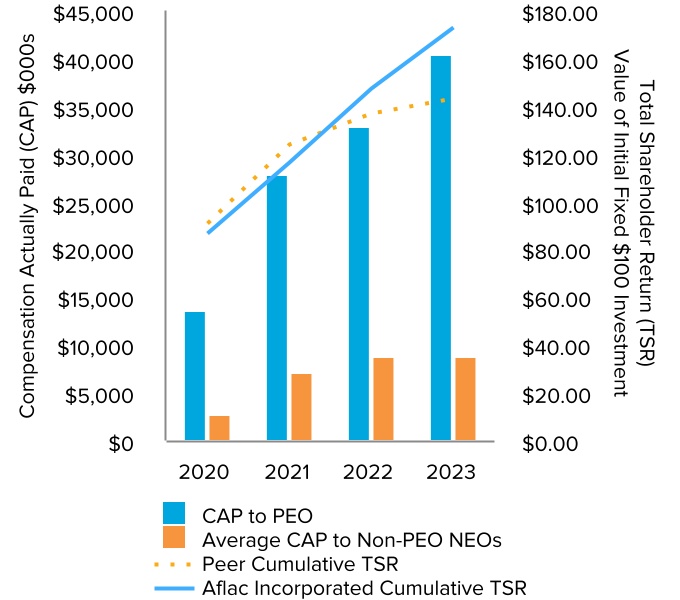

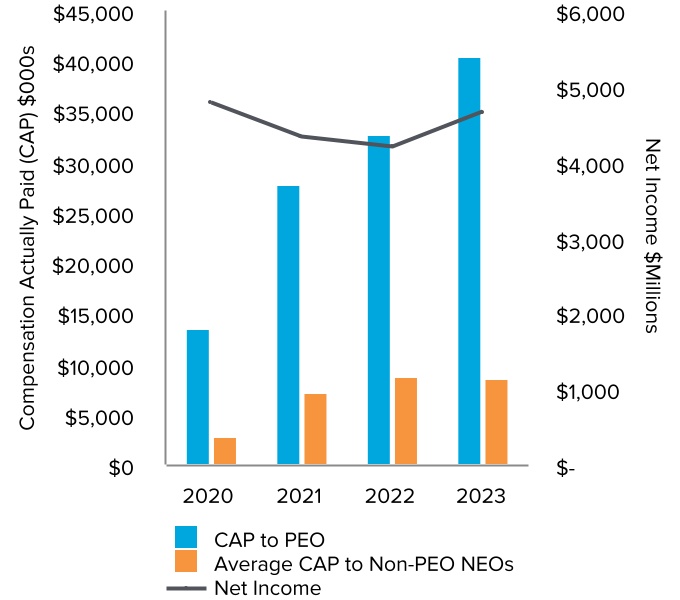

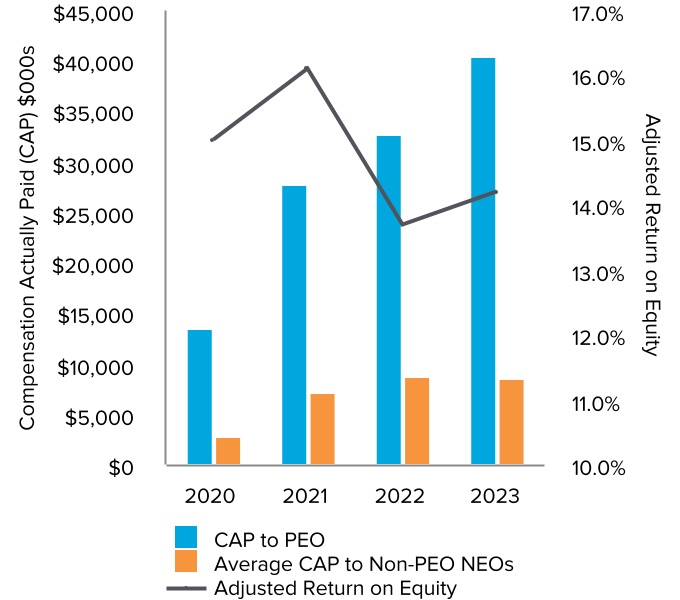

202020202023 for (1) our CEO and (2) our CEO together withthe average of our other NEOs is illustrated in the following charts and reflects the performance-based nature of our compensation program:CEO TARGET COMPENSATION MIX CEO +OTHER NEOs AVERAGE TARGET COMPENSATION MIX

Say-on-PaySay-On-Pay Votes2020SAY-ON-PAYSUPPORTWe are pleased that our named executive compensation program received the voting support of over 97% of our shareholders last year. We believe this continued support reflects favorably on changes we have made to our executive compensation program over the past few years to more tightly link compensation metrics to our business strategy while incorporating feedback received from our shareholders. We work hard to ensure we implement best practices in executive compensation while staying focused on performance-based program elements that align with shareholder interests. We will continue to review our compensation program each year to determine if additional changes are warranted.

AVERAGE

SUPPORT

We are pleased that, for the past two consecutive years, our executive compensation received the voting support of 98% of our shareholders. We believe this continued support reflects favorably on changes we have made to our executive compensation program over the past few years to more tightly link compensation metrics to our business strategy while incorporating feedback received from our shareholders. We work hard to ensure we implement best practices in executive compensation while staying focused on performance-based program elements that align with shareholder interests. As noted in the Program Changes for 2021 section of the Compensation Discussion and Analysis, the Compensation Committee has made changes to the Management Incentive Plan formula to include an ESG modifier for 2021. We will continue to review our compensation program each year to determine if additional changes are warranted.

| Learn more in the Compensation Discussion & Analysis | |||

|  | |||

| 2024 PROXY STATEMENT | 13 | |||||||

Attending the Virtual Annual Meeting

We continue to monitor developments regarding the coronavirus (COVID-19). In the interest of the health and well-being of our shareholders, the Board has made the decision that the Annual Meeting be held solely by means of remote communication.

How to Join the Virtual Annual Meeting

Shareholders as of the close of business on February 23, 2021 (Record Date) are invited to attend the virtual Annual Meeting at www.virtualshareholdermeeting.com/AFL2021 by entering the 16-digit control number included on their proxy card or notice that they previously received. If you hold your shares in street name and did not receive a 16-digit unique control number with your proxy materials, please contact your bank, broker, or other holder of record as soon as possible to obtain a valid legal proxy and for instructions on how to obtain a control number to be admitted to and to vote at the Annual Meeting. Online access to the webcast will open 15 minutes prior to the designated start time. Shareholders may submit questions in writing through the virtual meeting platform. Those who do not have a control number may attend as guests, but will not be able to vote shares or submit questions during the webcast. While voting during the virtual meeting will be permitted, Aflac Incorporated encourages shareholders to vote in advance of the meeting.

Vote BEFORE the meeting:

Vote by one of the following methods by 11:59 p.m. Eastern Time on May 2, 2021 for shares held directly and by 11:59 p.m. Eastern Time on April 28, 2021 for shares held in a Plan:

Go to www.proxyvote.com, or

Call 1-800-690-6903, or

Mark, sign and date your proxy card and return it in the postage-paid envelope we previously provided.

Vote DURING the meeting:

Go to www.virtualshareholdermeeting.com/ AFL2021.

Shareholders may attend and vote during the virtual Annual Meeting by following the instructions on the website above.

| ||||||||||||||||||||

| 14 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS | ||||||

Corporate Governance Matters

Information about the Board of Directors

|  |  |  |  |  |  |  |  |  |  | |

|  |  |  |  |  |  |  |  |  | ||

|  |  | |||||||||

|  |  | |||||||||

|  |  |  |  |  |  |  | ||||

|  |  |  |  | |||||||

|  |  |  |  |  |  |  |  |  | ||

|  |  |  |  |  |  |  |  |  | ||

|  |  |  |  |  | ||||||

| |||||||||||

|  |  | |||||||||

|  |  |  |  |  |  | |||||

|  | ||||||||||

|  | ||||||||||

|  |  |  |  |  |  | |||||

|  |  |  |

Corporate Governance Matters

Daniel P. Amos CHAIRMAN, CHIEF EXECUTIVE OFFICER AND PRESIDENT OF AFLAC INCORPORATED |  | W. Paul Bowers RETIRED CHAIRMAN AND CHIEF EXECUTIVE OFFICER OF

LEAD NON-MANAGEMENT DIRECTOR |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AGE 72 | DIRECTOR SINCE 1983 | COMMITTEES E FI | AGE 67 | DIRECTOR SINCE 2013 | COMMITTEES AR* CD CSR E | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Chief Executive Officer of •Chairman of Aflac Incorporated and Aflac since 2001 •President of Aflac from July 2017 to May 2018 •President of Aflac Incorporated since January 2024 and from February 2018 through December •Spent 50 years in various positions at

Notable Experience Aligned with Our Strategy and Key Board Contributions Mr. Amos’ more than 40 years of experience at Aflac Incorporated provides invaluable expertise and insights to both the leadership team and the Board on how to effectively execute strategic priorities in unpredictable macroeconomic and competitive landscapes. His experience and approach deliver insightful expertise and guidance to the Board

Mr. Amos has appeared five times on Institutional Investor magazine’s lists of America’s Best CEOs for the insurance category, has been recognized as one of the 100 Best-Performing CEOs in the World by the Harvard Business Review five times, and has received a Lifetime Achievement Award for his dedication to corporate responsibility by CRMagazine. Public Company Boards •Synovus Financial Corp. (2001-2011) •Southern Company (2000-2006) |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Retired as chairman and chief executive officer of Georgia Power, the largest subsidiary of Southern Company, a gas and electricity utility holding company, on July 1, 2021, a position that he held since •President of Georgia Power from 2011 until November •Chief financial officer of Southern Company from 2008 to •Served in various senior executive positions across Southern Company in Southern Company Generation, Southern Power, and the company’s former U.K. subsidiary, where he was president and chief executive officer of South Western Electricity LLC/Western Power

Distribution Notable Experience Aligned with Our Strategy and Key Board Contributions Mr. Bowers brings to the Board a valuable and unique perspective from his considerable financial knowledge, national and international business experience operating in a highly regulated industry, and expertise in corporate development and managing the evolving risks associated with

cybersecurit y.Public Company Boards •Brand Industrial Holding, Inc. (since 2019) •Audit Committee Chair (since 2019) •Exelon Corporation (since 2021) •Audit Committee and Corporate Governance Committee (since 2022) Other Board or Leadership Positions, Professional Memberships or Awards •Chair, Atlanta Committee for Progress (2016) •Nuclear Electric Insurance Ltd. (since 2009); Chairman(2017-2019) •Board of Regents of the University System of Georgia (2014-2018) •Federal Reserve Bank of Atlanta’s Energy Policy Council (2008-2018) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LEGEND: * Financial Expert • |

Risk • C Compensation • CD Corporate Development

• CG Corporate Governance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CSR Corporate Social Responsibility and Sustainability • E Executive

|  | Independent • |  | Chair • |  | Member | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORPORATE GOVERNANCE MATTERS | 2024 PROXY STATEMENT | 15 | ||||||

Arthur R. Collins FOUNDER AND CHAIRMAN OF theGROUP |  | Miwako Hosoda PROFESSOR, SEISA UNIVERSITY |  | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate Governance Matters

AGE 64 | DIRECTOR SINCE 2022 | COMMITTEES CG CSR | AGE 54 | DIRECTOR SINCE 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Founder and Chairman of theGROUP, a government relations and strategic communications consulting firm, since 2011 •Chairman and CEO

•Experienced and trusted strategic advisor to corporate leaders and domestic and foreign governments with concentrations in

•Additional areas of expertise include financial services, trade, energy, information technology, consumer products, agriculture, transportation, manufacturing, and national security Notable Experience Aligned with Our Strategy and Key Board Contributions Mr. Collins has more than 30 years of experience as a Public Company Boards •KB Home (since 2020) •Nominating and Corporate Governance Committee •Management Development and Compensation Committee •RLJ Lodging Trust (since 2016) •Compensation, Nominating and Corporate Governance Committees Other Board or Leadership Positions, Professional Memberships or Awards •Member, Council on Foreign Relations (since 2023) •Member, Ford’s Theatre Board of Trustees (since 2023) •Member, Smithsonian’s National Museum of Asian Art Board of Trustees (since 2022) •Vice Chair, Brookings Institution Board of Trustees (2014-2023) •Member, Economic Club of Washington, D.C. (since 2012) •Chairman, Morehouse School of Medicine Board of Trustees (since 2009) •Member, Meridian International Center Board of Trustees (2009-2017) •Chairman, Florida A&M University Board of Trustees (2001-2003) | •Professor, Seisa University, Faculty of Life Network Science from 2012 to present •Vice President from 2013 to 2021 •Research fellow, Harvard T.H. Chan School of Public Health •Abe Fellow in the Department of Society, Human Development and Health from 2010 to 2012 •Takemi Fellow in the Department of Global Health and Population, The Takemi Program in International Health from 2008 to 2010 •Associate, Columbia University, Mailman School of Public Health, Department of Sociomedical Sciences from 2005 to 2008 •Research Fellow, Japan Notable Experience Aligned with Our Strategy and Key Board Contributions Dr. Hosoda brings over 30 years of extensive Other Board or Leadership Positions, Professional Memberships or Awards •Board of Directors, The University of Tokyo, New York Office, Inc. (Since 2023) •Board of Directors, Brain Injury Caring Communities Society (2017 to •Representative Director, Inclusive Action For All (since 2020) •Vice president, Asia Pacific Sociological Association (since 2021); President (2017 to 2020) •Board of Trustees, The Japanese |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LEGEND: * Financial Expert • AR Audit and Risk • C Compensation • CD Corporate Development • CG Corporate Governance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CSR Corporate Social Responsibility and Sustainability • E Executive • FI Finance and Investment • |  | Independent • |  | Chair • |  | Member | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

16 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS | ||||||

Thomas J. Kenny FORMER PARTNER AND CO-HEAD OF GLOBAL FIXED INCOME, GOLDMAN SACHS ASSET MANAGEMENT

|  | Georgette D. Kiser OPERATING EXECUTIVE, THE CARLYLE GROUP |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AGE 60 | DIRECTOR SINCE 2015 | COMMITTEES CD CSR FI | AGE 56 | DIRECTOR SINCE 2019 | COMMITTEES AR* C | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Co Chair of •Held a variety of leadership positions at Goldman Sachs for twelve years, most recently serving as partner and advisory •Served as co-head of the Global Cash and Fixed Income Portfolio team at Goldman Sachs Asset Management, where he was responsible for overseeing the management of more than $600 billion in assets across multiple strategies with teams in London, Tokyo, and New •Spent thirteen years at Franklin •CFA charter

holder Notable Experience Aligned with Our Strategy and Key Board Contributions Mr.

expertise that supports our capital allocation decision-making and the evaluation of potential strategic transactions that drive long-term shareholder value. Other Board or Leadership Positions, Professional Memberships or Awards •Nuveen Funds (a TIAA Company), Co-Chair (since January 2024): •Executive Committee, Chair (since January 2024) •Investment Committee (since January 2024) •Compliance Committee (since January 2024) •Nomination and Governance Committee (since January 2024) •Open End Fund Committee (since January 2024) •ParentSquare (since 2021) •CREF Board of Trustees, Chairman ( 2017 through 2023) •TIAA-CREF Fund Complex: •Executive Committee, Chair •Investment Committee ( 2011 through 2023) •Audit and Compliance Committee ( 2018 through 2023) •Nominating and Governance Committee ( 2017 through 2023) •Ad Hoc CREF Special Projects Committee ( |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate Governance Matters

•Helps set IT strategy for Carlyle Portfolio companies and drives •Former managing director and chief information officer, •Developed and drove information technology strategies across the global enterprise, which includes the firm’s application development, data, digital, infrastructure, cybersecurity, and program management and outsourcing •Serves as an independent advisor who helps lead due diligence and technical strategies across various middle market private equity and venture capital firms •Led teams that provided creative solutions for investment front office, trading, and back-office operations at T. Rowe Price •Worked for General Electric within their aerospace unit Notable Experience Aligned with Our Strategy and

Key Board Contributions Throughout Ms. Kiser’s three-plus decade career, she has established extensive experience and success developing and leading talented teams to deliver decision support systems and technical solutions, including cybersecurity, for financial services firms. She has consistently been recognized for bringing credibility to solutions and technical organizations in addition to building strong business partnerships, leveraging human and technical resources, implementing investment and customer management systems, and producing advanced data management solutions.

Public Company Boards •Jacobs Engineering (since 2019) •Adtalem Global Education (since 2018) •NCR Voyix Corporation (formerly NCR Corporation) (since 2020)

Other Board

• | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LEGEND: * Financial Expert • AR Audit and Risk • C Compensation • CD Corporate Development • CG Corporate Governance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CSR Corporate Social Responsibility and Sustainability • E Executive • FI Finance and Investment • |  | Independent • |  | Chair • |  | Member | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORPORATE GOVERNANCE MATTERS | 2024 PROXY STATEMENT | 17 | ||||||

Karole F. Lloyd CERTIFIED PUBLIC ACCOUNTANT AND RETIRED ERNST & YOUNG LLP AUDIT PARTNER

|  | Nobuchika Mori REPRESENTATIVE DIRECTOR, JAPAN FINANCIAL AND ECONOMIC RESEARCH CO. LTD. |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AGE 65 | DIRECTOR SINCE 2017 | COMMITTEES AR* CDE FI | AGE 67 | DIRECTOR SINCE 2020 | COMMITTEES CG FI | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Certified public accountant and retired as vice chair and regional managing partner for Ernst & Young, LLP (“EY”), a global accounting firm, in December •Brings more than 37 years of work experience and leadership, most recently as part of the US Executive Board, Americas Operating Executive and the Global Practice Group for EY, and has extensive experience in the audits of large financial services, insurance, and health care •Served many of EY’s highest profile clients through mergers, IPOs, acquisitions, divestitures, and across numerous industries including banking, insurance, consumer products, transportation, real estate, manufacturing, and •Served as an audit partner for publicly held companies in both the United States and •Other experience includes leadership and consulting with respect to financial reporting, board governance and legal matters, regulatory compliance, internal audit, and risk

management Notable Experience Aligned with Our Strategy and Key Board Contributions Ms. Lloyd’s extensive accounting and advisory experience across the financial

helps inform our capital allocation decision-making and the evaluation of potential strategic transactions that drive long-term shareholder value. Public Company Boards •Churchill Downs Incorporated •Audit Committee Other Board or Leadership Positions, Professional Memberships or Awards •CERT Certificate in Cybersecurity Oversight •The University of Alabama President’s Advisory Council (since 2003) •The University of Alabama Board of Visitors for the Commerce and Business School (since 2001) •Atlanta Symphony Orchestra Board of Directors (since 2010) •Metro Atlanta Chamber of Commerce, Board of Trustees and Executive Committee(2009-2016) |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate Governance Matters

•Responsible for providing research and consulting services to companies in Japan and abroad since July •Eminent guest professor at the Center for Advanced Research in Finance, Graduate School of Economics, University of Tokyo (since July 2022) •Senior research scholar and adjunct professor •Commissioner of the Financial Services Agency of Japan (the “JFSA”), Japan’s integrated financial •Led supervision of financial institutions including banks, securities firms and insurance companies •Directed legislative and regulatory planning to ensure financial stability and enhance economic growth in •More than 30 years in senior positions at JFSA and Japan’s Ministry of Finance (the “MOF”) •JFSA Vice Commissioner for Policy Coordination •JFSA Director General for Inspection •JFSA Director General for Supervision •Served in a range of diplomatic posts reflecting his expertise in international financial markets and regulatory standards, •Chief Representative in New York for the MOF •Minister of the Embassy of Japan in the United States of America •Deputy Treasurer at the Inter-American Development

Bank Notable Experience Aligned with Our Strategy and Key Board Contributions Over a three-plus decade career immersed in Japan’s finance industry as a financial regulator, policymaker, and standard setter in Japan and internationally, Mr. Mori gained extensive specialized economic, policy, and financial regulatory expertise, knowledge and experience. He brings to the Board indispensable, significant insight with respect to the Company’s Japanese business operations from his considerable financial and economic knowledge, international business experience, and regulatory acumen spanning highly regulated industries in Japan and internationally.

Other Board or Leadership Positions, Professional Memberships or Awards •Center on Japanese Economy and Business (CJEB) Professional Fellow (since 2018) |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LEGEND: * Financial Expert • AR Audit and Risk • C Compensation • CD Corporate Development • CG Corporate Governance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CSR Corporate Social Responsibility and Sustainability • E Executive • FI Finance and Investment • |  | Independent • |  | Chair • |  | Member | |||||||||||||||||||||||||||||||||||||||||||||||||||||

18 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS | ||||||

Joseph L. Moskowitz RETIRED EXECUTIVE VICE PRESIDENT, PRIMERICA, INC.

|  | Katherine T. Rohrer VICE PROVOST EMERITUS, PRINCETON UNIVERSITY |  | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AGE 70 | DIRECTOR SINCE 2015 | COMMITTEES AR* C CD E | AGE 70 | DIRECTOR SINCE 2017 | COMMITTEES C CG E | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Executive vice president of Primerica, Inc., an insurance and investments company, •Joined Primerica in 1988 and served in various capacities, including managing the group responsible for financial budgeting, capital management support, earnings analysis, and analyst and stockholder communications •Chief actuary from 1999 to •Vice president of Sun Life Insurance Company from 1985 to 1988 •Senior manager at KPMG from 1979 to

1985 Notable Experience Aligned with Our Strategy and Key Board Contributions With forty years of actuarial experience and leadership roles in the

assessment. Other Board or Leadership Positions, Professional Memberships or Awards •Fellow, Society of Actuaries(since 1979) •Member, American Academy of Actuaries(since 1979) |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate Governance Matters

•

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

•Vice provost for Academic Programs from 2001 until •Held several senior leadership positions •Served as interim associate dean of the graduate school in •Assistant professor at Columbia University •Trustee of Emory University, where she serves on the executive committee as well as the academic affairs committee, which she chaired from 2013 to

2020 Notable Experience Aligned with Our Strategy and Key Board Contributions With more than 30 years as a university leader, Dr. Rohrer

Other Board or Leadership Positions, Professional Memberships or Awards •Emory University Board of Trustees •Academic Affairs Committee (Chair 2013-2020) •Executive Committee •Finance Committee (2014-2020) •Previously served on the boards of Morristown-Beard School, Morristown, NJ; Trinity Church, Princeton, NJ; Crisis Ministry of Trenton and Princeton (now “Arm in Arm”); and Dryden | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LEGEND: * Financial Expert • AR Audit and Risk • C Compensation • CD Corporate Development • CG Corporate Governance | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate Governance Matters

|

|  | Independent • |  | Chair • |  | Member | |||||||||||||||||||||||||||||||||||||

a diverse balance of longer tenured members and newer members |  | ||||

Board Changes since 2019 4 of 4 new nominees have been women and/or people of color | Skills of Directors Joining the Board since 2019 | ||||||||||

| INVESTMENT AND FINANCIAL | ||||||||||

| REGULATORY AND RISK MANAGEMENT | ||||||||||

| PUBLIC HEALTH | ||||||||||

| OPERATIONS | ||||||||||

| JAPANESE MARKET | ||||||||||

| INDUSTRY | ||||||||||

| DIGITAL/CYBERSECURITY | ||||||||||

| 20 | AFLAC INCORPORATED | CORPORATE GOVERNANCE MATTERS | ||||||